Open an Account with MubasherTrade

Unlike other online trading platforms, MubasherTrade Web brings you access to multi market funds, equities and derivatives through a single account.

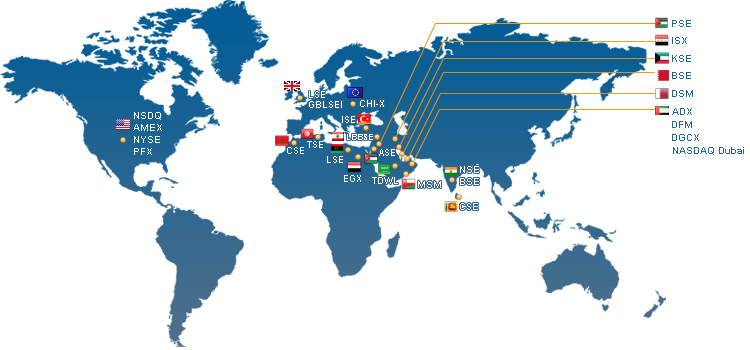

Trade the Global Markets

MubasherTrade Market Coverage

Significant international and regional presence

MubasherTrade operates across the borders and the markets that are considered financial hotspots as well as those that represent dynamic potential, to create opportunities that may be leveraged to enhance and solidify investment portfolios.

| Region | Country | Method | Exchange |

|---|---|---|---|

| MENA | U.A.E | DMA | NASDAQ (Dubai) |

| U.A.E | DMA | DFM (Dubai) | |

| U.A.E | DMA | ADX (Abu Dhabi) | |

| Bahrain | DMA | BSE | |

| Saudi Arabia | DMA | TDWL | |

| Kuwait | DMA | KSE | |

| Qatar | DMA | DSM | |

| Oman | DMA | MSM | |

| Egypt | DMA | CASE | |

| Morocco | Over the phone | CSE | |

| Tunis | Over the phone | TSE | |

| Libya | Over the phone | LSM | |

| Palestine | DMA | PSE | |

| Lebanon | DMA | LBBSE | |

| Jordan | DMA | ASE | |

| Americas | United States | DMA | NYSE |

| United States | DMA | AMEX | |

| United States | DMA | NSDQ | |

| United States | DMA | OPRA (Options) | |

| Europe | United Kingdom | DMA | LSE |

| London | DMA | CHI-X Europe | |

| Paris | DMA | CHI-X Europe | |

| Frankfurt | DMA | CHI-X Europe | |

| Milan | DMA | CHI-X Europe | |

| Zurich | DMA | CHI-X Europe | |

| Stockholm | DMA | CHI-X Europe | |

| Amsterdam | DMA | CHI-X Europe | |

| Madrid | DMA | CHI-X Europe | |

| Oslo | DMA | CHI-X Europe | |

| Brussels | DMA | CHI-X Europe | |

| Helsinki | DMA | CHI-X Europe | |

| Copenhagen | DMA | CHI-X Europe | |

| Vienna | DMA | CHI-X Europe | |

| Dublin | DMA | CHI-X Europe | |

| Lisbon | DMA | CHI-X Europe | |

| ASIA | India | DMA | BSE (Operated by local partner) |

| India | DMA | NSE (Operated by local partner) | |

| Sri lanka | DMA | CSE | |

| Turkey | DMA | ISE |

United Arab Emirates - Abu Dhabi Exchange (ADX)

General Information

Index:ADXGI

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:AED (UAE Dirham)

| Working Hours: | 10.00 am – 2.00 pm (UAE - GMT+4) | |||||

|

No of Listed Companies:64 Companies

Market Capital:$75.6 billion source: AM (As of March)

Settlement Cycle:T+2 (custody accounts)

Most Active Stocks in USD (3m avg volume x close)

- ALDAR 6.3 M

- ETISALAT 4 M

- DANA 3.1 M

- FGB 2.7 M

- SOROUH 2 M

Biggest Weight in the Index

- ETISALAT 32.1 %

- NBAD 9.9 %

- QTEL 9.1%

- FGB 8.9%

- ADCB 4%

Trading

Order Types

- Market and Limit

- Day Order

- Fill or Kill (FOK)

- Week Order (GTW)

- Month Order (GTM)

- AON

- Minimum Fill (MB)

- Minimum Block (MF)

| Example Investor ID | BHR00000123456X |

|---|---|

| Limit Up & Limit Down | 15% & 10% |

| Closing Price | Average Price - VWAP |

| DMA | YES |

Priority

- Price - the order with the best price has the highest queue priority.

- Time - at a single price level, time of entry of an order governs its priority on a First in First Out (FIFO) basis.

- Special Term - orders with the least trading restrictions will be given priority over orders with greater restrictions

- Amending order quantity will result in the order losing priority.

General Rules

- During pre open session, orders can't be amended or cancelled within 10 minutes of placing the order.

- Multiple orders at the same price pointed by the same investor are not allowed and will result in a fine.

- Order values must be under 10 million, orders above 10 million require approval by the exchange and placed in the special order book.

Tick Sizes

| Price From | Price To | Tick Size (AED) |

|---|---|---|

| 0.01 | 10.00 | 0.01 |

| 10.05 | 100.00 | 0.05 |

| 100.10 | Above | 0.10 |

Foreign Investor Laws

Foreign Investor restrictions are placed on stock by stock basis.

United Arab Emirates - Dubai Financial Market (DFM)

General Information

Index:DFMG

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:AED (UAE Dirham) AED/USD 3.6730

| Working Hours: | 10.00 am – 2.00 pm (UAE - GMT+4) | |||||

|

No of Listed Companies:74 Companies

Market Capital:$ 10.8 billion USD: AMF March 2011

Settlement Cycle:T+2 (custody accounts)

Most Active Stocks in USD (3m avg volume x close)

- EMAAR 10.3 M

- ARABTEC 6.3

- DSI 3.5 M

- DU 3.3 M

- Air Arabia 3 M

Biggest Weight in the Index

- EMAAR 17%

- DIB 14.1 %

- Emirate NDB 8.2%

- DU 8%

- Dubai Investments 6.4%

Trading

Order Types

- Day Orders,

- Market,

- Limit,

- Good Till Date,

- Good Till Cancel,

| Example Investor ID | BH00123456 |

|---|---|

| Limit Up & Limit Down | Active Stock - 15% up 10% Down Inactive Stock - 5% up 5% Down |

| Closing Price | Average Price - VWAP |

| DMA | YES |

Priority

- Price - the order with the best price has the highest queue priority.

- Time - at a single price level, time of entry of an order governs its priority on a First in First Out (FIFO) basis.

- Special Term - orders with the least trading restrictions will be given priority over orders with greater restrictions

- Amending order quantity will result in the order losing priority.

General Rules

- During pre open session, orders can't be amended or cancelled within 10 minutes of placing the order.

- Multiple orders at the same price point by the same investor are not allowed and will result in a fine.

- Order values must be under 10 million; orders above 10 million require approval by the exchange and placed in the special order book.

- GTC orders where the share price moves outside the maximum allowed trading range will be suspended until share price moves back into range

- Market Regulator is Securities and Commodities Authority (SCA)

- Ex-NASDAQ Dubai symbols (eg. DPW,DEPA,DAMAS) trade in USD

Tick Sizes

| Price From | Price To | Tick Size (AED) |

|---|---|---|

| 0.01 | 1.00 | 0.001 |

| 1.00 | 10.00 | 0.01 |

| 10.0 | 100.00 | 0.05 |

| 100.0 | Above | 0.10 |

Foreign Investor Laws

Foreign Investment restrictions are placed on a stock by stock basis.

To check the restrictions placed on a particular stock follow the link below:

Kingdom of Saudi Arabia - Saudi Arabia Tadawul (TDWL)

General Information

Index:TASI

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:SAR (Saudi Riyal) SAR/USD 3.75

| Working Hours: | 11:00 am – 03:30 pm (Saudi Arabia – GMT+3) | |||||

|

No of Listed Companies:148 Companies

Market Capital:$ 135 B USD: AMF March 2010

Settlement Cycle:T+0 (Prefunded)

Most Active Stocks in USD (3m avg volume x close)

- SABIC 155 M

- KAYAN 63.5 M

- ALINMA 48.3 M

- RHAJI 39.9 M

- MAADEN 31.3 M

Biggest Weight in the Index

- SABIC 13.3%

- RHAJI 12.1%

- SAMBA 4.1%

- ETIHAD ETISALAT 3.9%

- RIYAD 3.6%

Trading

Order Types

- Hit Order

- Take Order

- Match Order

- Market Order

- Limit Order

- Unpriced Order

- Undisclosed volume

- All or None

- Minimum Block

- Minimum Fill

- Fill or Kill orders

| Example Investor ID | 0123456789 |

|---|---|

| Limit Up & Limit Down | 10% up, 10% Down |

| Closing Price | Last Traded Price |

| DMA | Yes |

Time in force restrictions

- Good-till-day

- Good-till-week

- Good-till-month

General Rules

- Amending order quantity will result in the order losing priority.

- Market Regulator is Capital Market Authority CMA

Tick Sizes

| Price From | Price To | Tick Size (AED) |

|---|---|---|

| 0 | 25 | 0.05 |

| 25 | 50 | 0.10 |

| 50 | Above | 0.25 |

Foreign Investor Laws

Foreign Investors are now permitted to trade on the TADAWUL Exchange using the SWAP agreement.

Kuwait - Kuwait Stock Exchange (KSE)

General Information

Index:KSE

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:KWD, KWD/USD 0.2782

| Working Hours: | 9.00 am – 13.30 pm Local Time | |||||||

|

No of Listed Companies:232 Companies

Market Capital:117.9 USD Billion AMF March 2010

Settlement Cycle:T+2 (custody accounts)

Most Active Stocks in USD (3m avg volume x close)

- NBK 17.2M

- ZAIN 12.1M

- KFIN 11.4M

- ALAFCO 8.3M

- KIB 8.2

Biggest Weight in the Index

- CGC 3.9%

- CABLE 3.3%

- NMTC 3.3%

- PCEM 3.2%

- FOOD 3.1%

Trading

Order Types

- Day Orders

- Limit Order

- Market Order

| Example Investor ID | 12345678 |

|---|---|

| Limit Up & Limit Down | Stock specific, please refer to table below. |

| Closing Price | Last Traded Price |

| DMA | Yes |

General Rules

- Amendments and cancelation or orders can only be done after 5 minutes of placing the order has elapsed.

- Amending order quantity will result in the order losing priority.

- No segregated market regulator, the Kuwait Stock Exchange is overseeing the functioning of the market and the market participants.

Tick Sizes

| Value Unit | Max Daily Change (5 Units) | Unit Change (Fils) | Stock Price (Fils) |

|---|---|---|---|

| 80,000 | 5x0.5 = 2.5 Fils | 0.5 | 50 : 0.5 |

| 40,000 | 5x1 = 5 Fils | 1 | 100 : 51 |

| 20,000 | 5x2 = 10 Fils | 2 | 250 : 102 |

| 10,000 | 5x5 = 25 Fils | 5 | 500 : 255 |

| 5,000 | 5x10 = 50 Fils | 10 | 1,000 : 510 |

| 2,500 | 5x20 = 100 Fils | 20 | 2,520 : 1,020 |

| 1,000 | 5x20 = 100 Fils | 20 | 5,000 : 2,520 |

| 500 | 50X5 = 250 Fils | 50 | 9,950 : 5,050 |

Foreign Investor Laws

Foreign investors are restricted to 49% ownership (5% for banking stocks)

Qatar - Qatar Exchange (QE)

General Information

Index:QE Index

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:(QAR) Qatari Riyal, QAR/USD 364

| Working Hours: | 10.00 am – 12.30 pm (Qatar – GMT+3) | |||||||

|

No of Listed Companies:45 Companies

Market Capitalization (QE Index):$ 47.6 billion USD AMF March 2010

Settlement Cycle:T+3 (custody accounts)

Most Active Stocks in USD (3m avg volume x close)

- MARK 17.9M

- IQCD 16.2

- BRES 13.6M

- QNBK 9.6M

- QIBK 8.5M

Biggest Weight in the Index

- QNBK 15.8%

- IQCD 13.2%

- QIBK 9%

- CBQK 8.5%

- MARK 8.4%

Trading

Order Types

- Day Orders

- Market

- Limit

| Example Investor ID | 123456 |

|---|---|

| Limit Up & Limit Down | 10% up, 10% down |

| Closing Price | Average Price |

| DMA | Yes |

Time in force restrictions

- Valid (good) for a day.

- Valid (good) for a week.

- Valid (good) for a month.

Priority

- Price

- Time of entry

- Type of order

General Rules

- During pre open session, orders can't be amended or cancelled within 15 minutes of placing the order.

- Orders placed during normal trading can be updated anytime after placing the order.

- Order values must be under 10 million; orders above 10 million require approval by the exchange and placed in the special order book.

- GTC orders where the share price moves outside the maximum allowed trading range will be cancelled from the market

- Market Regulator is Qatar Financial Market Authority.

Foreign Investor Laws

25% of free float for most companies:

Bahrain - Bahrain Stock Exchange (BSE)

General Information

Index:Bahrain All Share Index

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:BHD (Bahrain Dinar), BHD/USD 0.377

| Working Hours: | 9.30 am – 12.30 pm (Bahrain GMT + 3) | |||||||

|

No of Listed Companies:76 Companies

Market Capital:15.9BN USD

Settlement Cycle:T+2 (custody accounts)

Most Active Stocks in USD (3m avg volume x close)

- AUB 300K

- BARKA 200K

- BATELCO 200K

- SALAM 40K

- ITHMR 30K

Biggest Weight in the Index

- AUB 22%

- ABC 11.1%

- BATELCO 9.8%

- NBB 9.3%

- BBK 6.4%

Trading

Order Types

- Limit Order

- Market Orders

- Day Orders

| Example Investor ID | BAH1234567CR |

|---|---|

| Limit Up & Limit Down | 10% up 10% down |

| Closing Price | Last Traded Price |

| DMA | YES |

TIF

- Orders are allowed to have time restrictions, which limit the period the order is available to trade. The order will be automatically removed after close of trading for the stipulated day.

General Rules

- Orders placed with an order value larger than 5% of the shares capital must be approved by the exchange and placed in the special order book.

- Amending order quantity will result in the order losing priority.

Board Lots

Orders must be entered within the defined board lots and tick sizes, as specified by the Exchange.

All trades shall be executed within the trade ranges as set by the Exchange.

Stocks Traded in Bahrain Dinars

| Class | Price (BD) From | Price (BD) To | Board Lot |

|---|---|---|---|

| 1 | 0.001 | 0.050 | 10,000 |

| 2 | 0.051 | 0.100 | 5,000 |

| 3 | 0.101 | 0.250 | 2,000 |

| 4 | 0.251 | 0.500 | 1,000 |

| 5 | 0.501 | Above | 500 |

Stocks Traded in USD

| Class | Price (BD) From | Price (BD) To | Board Lot |

|---|---|---|---|

| 1 | 0.01 | 2.00 | 1000 |

| 2 | 2.01 | 4.00 | 400 |

| 3 | 4.01 | 10.00 | 200 |

| 4 | 10.01 | Above | 100 |

Tick Sizes

Stocks Traded in Bahrain Dinars

| Class | Price (BD) From | Price (BD) To | Tick Size (Fils) |

|---|---|---|---|

| 1 | 0.001 | 0.200 | 1 |

| 2 | 0.201 | 0.500 | 2 |

| 3 | 0.501 | 1.000 | 5 |

| 4 | 1.001 | 2.500 | 10 |

| 5 | 2.501 | Above | 20 |

Stocks Traded in USD

| Class | Price From | Price To | Tick Size (Fils) |

|---|---|---|---|

| 1 | 0.01 | 2.00 | 1 |

| 2 | 2.01 | 4.00 | 2 |

| 3 | 4.01 | 10.00 | 4 |

| 4 | 10.01 | Above | 5 |

List of Companies and Traded Currency

| Company Name | Currency | Symbol |

|---|---|---|

| Ahli United Bank | USD | AUB |

| Al Salam Bank | BHD | SALAM |

| Bahrain Islamic Bank | BHD | BISB |

| BBK | BHD | BBK |

| Khaleeji Commercial Bank | BHD | KHCB |

| National Bank of Bahrain | BHD | NBB |

| The Bahraini Saudi Bank | BHD | BSB |

| Al Baraka Banking Group B.S.C. | USD | BARKA |

| Arab Banking Corporation | USD | ABC |

| Bahrain Commercial Facilities | BHD | BCFC |

| Bahrain Middle East Bank | BHD | BMB |

| Esterad Investment Company B.S.C. | BHD | ESTERAD |

| GMG (Suspended) | BHD | GMG |

| Gulf Finance House | USD | GFH |

| INOVEST B.S.C. | USD | INOVEST |

| Investcorp Bank | USD | INVCORP |

| Ithmaar Bank | USD | ITHMR |

| TAIB Bank | USD | TAIB |

| United Gulf Bank | BHD | UGB |

| United Gulf Investment Corporation B.S.C | BHD | UGIC |

| AUB Class A Preference Share | USD | AUB.PREF.A |

| Securities and Investment Co | BHD | SICO-C |

| United Paper Industries B.S.C | BHD | UPI |

| AIIC (Suspended) | BHD | AIIC |

| Al-Ahlia Insurance Co. | BHD | AHLIA |

| Arab Insurance Group | USD | ARIG |

| Bahrain Kuwait Insurance Co | BH HHD |

BKIC |

| Bahrain National Holding Co. | BHD | BNH |

| Takaful International Company | BHD | TAKAFUL |

| Bah. Ship Repairing & Engineering Co. | BHD | BASREC |

| Bahrain Car Park Co. | BHD | CPARK |

| Bahrain Cinema Co. | BHD | CINEMA |

| Bahrain Duty Free Shop Complex | BHD | DUTYF |

| Bahrain Mari. & Mer. Inter. Co. | BHD | BMMI |

| Bahrain Telecommunications Co. | BHD | BATELCO |

| General Trading & Food Proc. Co. | BHD | TRAFCO |

| Nass Corporation BSC | BHD | NASS |

| Seef Properties B.S.C. | BHD | SEEF |

| Bahrain Family Leisure Co. | BHD | FAMILY |

| Bahrain Tourism Co. | BHD | BTC |

| Banader Hotels Company BSC | BHD | BANADER |

| Gulf Hotel Group B.S.C | BHD | BHOTEL |

| National Hotels Co | BHD | NHOTEL |

| Bahrain Flour Mills Co. | BHD | BFM |

| Delmon Poultry Co. | BHD | POLTRY |

| Bank Muscat | BHD | BMUSC |

| Global Investment House | BHD | GLOBAL |

| International Investment Group | BHD | IIG |

| Sudan Telecommunications Company | USD | SDTL |

| United Finance Company SAOG | USD | UFC |

Foreign Investor Laws

In 1999, following Amiri Decree No. 10/1999, GCC nationals were allowed to own up to 100% of the shares of listed Bahraini companies, giving them full access to the market. Likewise, non-GCC nationals are now allowed to own up to 49%. Both Bahrain Flour Mills Company and Delmon Poultry Company are not subject to the above decree as ownership in their shares is restricted to Bahraini citizens only

Oman - Muscat Securities Market (MSM)

General Information

Index:MSM

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:OMR (Omani Riyal), ORM/USD 0.385

| Working Hours: | 10.00 am – 1.00 pm (Oman – GMT+4) | |||||

|

||||||

|

OTC Market

|

No of Listed Companies:190 Companies

Market Capital:5.8 USD Billion

Settlement Cycle:T+3 (custody accounts)

Most Active Stocks in USD (3m avg volume x close)

- BKMB 2.7M

- RNSS 2.2M

- GECS 900K

- OTEL 700K

- BKSB 400K

Biggest Weight in the Index

- BKBB 10.7%

- Otel 9.7%

- RNSS 9.5%

- BKMB 9.1%

- OIBB 7.5%

Trading

Order Types

| Type | Pre Open | Trading |

|---|---|---|

| Limit Price Order | YES | YES |

| Market Order | YES | YES |

| Market To Limit Order | NO | YES |

| Open Price Order | YES | NO |

| Stop Order | YES | YES |

| Stop Limit Order | YES | YES |

| On 1st Limit Order | YES | YES |

| FAK Market Order | YES | YES |

| Example Investor ID | OM0000123456 |

|---|---|

| Limit Up & Limit Down | 10% up 10% down |

| Closing Price | Last Traded Price |

| DMA | Yes |

Time in force restrictions

- (Day): Valid for one day.

- (Fill & Kill): Valid for immediate execution.

- (Good Till Date): Valid for a certain date.

- (Sliding Validity): Valid for one year.

Priority

- Price.

- Time of entry.

- Type of order

Foreign Investor Laws

Foreign Investor restrictions are placed on a stock by stock basis.

Jordan - Amman Stock Exchange (ASE)

General Information

Index:ASE

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:JOD (Jordanian Dinar), USD, JOD/USD 0.7086

| Working Hours: | 9.30 am – 2.00 pm (Jordan – GMT +3) | |||||||||||||||||

|

No of Listed Companies:271 Companies

Market Capital:4.2BN USD

Settlement Cycle:T+3

Most Active Stocks in USD (3m avg volume x close)

- MECE 1.8M

- ARBK 1.2M

- JOBH 900K

- TAMR 800K

- RJAL 700K

Biggest Weight in the Index

- ARBK 9.2%

- THBK 9.2%

- JOEP 7.7%

- JTEL 4.7%

- JOKB 4.4%

Trading

Order Types

- Day Orders

- GTC

- FOK

- FAK

- GTD

| Example Investor ID | 1234 |

|---|---|

| Limit Up & Limit Down | 5% up, 5% down |

| Closing Price | Last Traded Price |

| DMA | NO |

General Rules

- Cross orders are only allowed during pre-close session and must be approved by the exchange though a fax.

- Orders can amended and cancelled any time after placing an order during all sessions.

Foreign Investor Laws

Foreign investors are restricted to a percentage of ownership or participation in certain sectors

Palestine - Palestine Securities Exchange (PSE)

General Information

Index:PSE

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:USD, JOD

| Working Hours: | 9.45 am – 1.30 pm (Palestine – GMT+2) | |||||||

|

No of Listed Companies:48 Companies

Market Capital:3 USD Billion

Settlement Cycle:T+3

Most Active Stocks

- Arab Islamic Bank (AIB)

- Palestine Telecommunication Co (PALTEL)

Trading

Order Types

- Day Orders,

- GTC,

- FOK,

- FAK,

- GTD

| Example Investor ID | 1234567890 |

|---|---|

| Limit Up & Limit Down | 7.50% Primary MKT, 5% Secondary MKT |

| Closing Price | Last Traded Price |

| DMA | NO |

Priority

- An Order that includes the best price shall be given priority when executing such Order.

- The Purchase Order that includes the highest price and the Sale Order that includes the lowest price shall be given preference when executing such Orders.

- If the Order is not executed in full according to the best price, the remaining of such Order shall then be executed at the next best price and in accordance with the provisions of these Regulations.

Tick Sizes

- 0.01), if the share par value and/or market value is less than 5 Jordanian dinars or 5 US dollars.

- (0.05), if the share par value and/or market value is less than 10 Jordanian dinars or 10 US dollars.

- (0.10), if the share par value and/or market value is equal to or more than 10 Jordanian dinars or 10 US dollars.

General Rules

- Cross orders are only allowed during pre-close session and must be approved by the exchange though a fax.

- Orders can be amended and cancelled any time after placing an order during all sessions.

- Amending order quantity will result in the order losing priority.

Settlement

The CDS system begins processing thirty seconds following a trade. The system handles the daily cash settlement process between trading members and the associated tracking of share movement related to the settled securities. A number of procedures serve as safeguards in tracking the transaction through the process leading up to Delivery versus Payment three days following the trade date (T+3).

Foreign Investor Laws

No restrictions for foreign investors.

Lebanon - Beirut Stock Exchange (LBBSE)

General Information

Index:BLOM Index

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:USD, LBP

| Working Hours: | 9.00 am – 12.30 pm Local Time (GMT +2) | |||||

|

No of Listed Companies:26 Companies

Market Capital:10.7B USD

Settlement Cycle:T+3

Most Active Stocks in USD (3m avg volume x close)

- SOLIDERA 600K

- SOLIDEREB 200K

- AUSR 160K

- BYB 150K

- BLBD 120K

Biggest Weight in the Index

- BLOOM Bank 40%

- SOLIDERA 16.9%

- BANK AUDI 16.7%

- SOLIDEREB 10.8%

- BYLOS 6.2%

Trading

Order Types

- Limit Order

- Market to limit orders

- On first limit orders

- Execution Conditions - Fill and Kill, Minimum Quantity, Iceberg Orders

- Order Validity - Good for Day (GFD), Good Till Date (GTD), Good Till Cancel (GTC)

| Example Investor ID | 757732 |

|---|---|

| Limit Up & Limit Down | 5% up, 5% Down |

| Closing Price | Last Traded Price |

| DMA | YES |

Tick Sizes

| Price From | Price To | Tick Size (USD) |

|---|---|---|

| 0 | 49.99 | 0.01 |

| 50 | 99.99 | 0.05 |

| 100 | 499.99 | 0.10 |

| 500 | Above | 0.50 |

| Price From | Price To | Tick Size (LBP) |

|---|---|---|

| 0 | 49,999.99 | 10 |

| 50,000 | 99,999.99 | 50 |

| 100,000 | 4,999,999.99 | 100 |

| 5,000,000 | Above | 500 |

Egypt - The Egyptian Exchange (EGX)

General Information

Index:EGX

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:EGP, EGP/USD 6.035

| Working Hours: | 9.45am – 2.30 pm (Egypt – GMT+2) | |||||||

|

No of Listed Companies: 213 Companies

Market Capital: 300 B EGP / 50 B USD ($)

Settlement Cycle:T+2

Most Active Stocks in USD (3m avg volume x close)

- COMI 12.7M

- ORTE 11.9M

- OCIC 8.7M

- TMGH 4.1M

- CCAP 2.8M

Biggest Weight in the Index

- COMI 12.2%

- OCIC 19.9%

- ORTEL 9.6%

- HRHO 8.2%

- TMGH 6.4%

Trading

Order Types

- Market Order

- Limit Order

- Limit Order (Minimum fill, All or none, Fill or kill, Fill and kill )

| Example Investor ID | 011234567890 |

|---|---|

| Closing Price | Average Price |

| DMA | Yes |

Limit Up & Limit Down

5% up or 10% down the market session will be suspended for 30 minutes, 10% up or 10% down, the session will be suspended for another 30 minutes, Certain symbols are limit down and limit up to 5% only , for the list of symbols please contact us.

Time in Force Restrictions

- Good till day.

- Good till week.

- Good till month.

- Good till date.

- Good till cancel.

Priority

- Price - the order with the best price has the highest queue priority.

- Cross - the lowest priority is given for matching an order of the same buyer and seller broker.

- Time - at a single price level, time of entry of an order governs its priority on a First in First Out (FIFO) basis.

- Special Term - orders with the least trading restrictions will be given priority over orders with greater restrictions.

- Amend order price or quantity will loss the priority if increase the price, Increase the Quantity, or decrease the price , the only case will not loss the priority if decrease the quantity.

General Rules

- During pre open 10 minutes before open of regular trading orders cant be placed, amended or cancelled.

- Certain stocks have to be traded on within the same day, these stock are reviewed every quarter.

- Market Regulator is The Egyptian Financial Supervisory Authority.

Foreign Investor Laws

Foreign investor restrictions are applied to trades on the following symbols

- SCEM.

- ABUK.

- SDTI.

- EXPA.

Companies traded in another currency other than the local currency.

| Symbol | Currency |

|---|---|

| ODHL | Swiss Franc |

| EKHO | USD |

| NAHO | USD |

Companies Listed on the OTC Market.

The companies listed in the OTC market are as follows:

|

|

No limits ups and limit downs for symbols traded on the OCT Market.

Tunisia - Tunis Stock Exchange (TNTSE)

General Information

Index:TUNINDEX

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:Tunisian Dollar TND TND/USD 1.3983

| Working Hours: | 9.00 am – 2.05 pm Local Time (GMT +1) | |||||||

|

No of Listed Companies:50 Companies

Market Capital:3.5BN USD

Settlement Cycle:T+3

Most Active Stocks in USD (3m avg volume x close)

- SALIM 300K

- BT 250K

- BIAT 220K

- NAKL 160K

- TRE 140K

Biggest Weight in the Index

- BT 16%

- BIAT 8.3%

- SFBBT 6.2

- TJARI 5.2%

- UIB 4.7%

Trading

Order Types

- At Best (only in opening session)

- Limit Order

- Market

- Stop Orders

- Execution Conditions - Fill and Kill, Stop Loss, Stop Limit

- Order Validity - Good for Day (GFD), Good Till Date (GTD) (Maximum 30 Days)

| Example Investor ID | EL20069 |

|---|---|

| Limit Up & Limit Down | 5% up, 5% Down |

| Closing Price | Last Traded Price |

| DMA | NO |

Foreign Ownership

Foreign Ownership in the Tunis Stock exchange varies according to each stock, follow the link below to find a detailed breakdown of foreign ownership.

Morocco - Casablanca Stock Exchange (CSE)

General Information

Index:MASI – Moroccan All Share Index

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies:Moroccan Dirham (MAD) MAD/USD 8.0702

| Working Hours: | 9.00 am – 3.30 pm Local Time (GMT +1) | |||||||

|

No of Listed Companies:102 Companies

Market Capital:16.1 BN USD

Settlement Cycle:T+3

Most Active Stocks in USD (3m avg volume x close)

- AUB 300K

- BARKA 200K

- BATELCO 200K

- SALAM 40K

- ITHMR 30K

Biggest Weight in the Index

- IAM 19.8%

- ATW 15.4%

- ADH 10.4

- BCE 6.3%

- BCP 5.5%

Trading

Order Types

- Limit Order

- Market Orders

- Execution Conditions (Order Types)

(Fill and Kill, Stop Loss, Stop Limit, Agency Cross) - An order is valid for a maximum of 30 calendar days.

| Example Investor ID | 4000050340 |

|---|---|

| Limit Up & Limit Down | 5% up, 5% Down |

| Closing Price | Last Traded Price |

| DMA | NO |

United Kingdom - London Stock Exchange (LSE)

General Information

Index: FTSE 100

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies: GBP or GBX (GDRs traded in USD or EUR)

| Working Hours: | 08.00 am – 4.30 pm Local Time (GMT) | |||||

|

No of Listed Companies: 1,800 Listed Companies on LSE Main Market

Market Capital: $2.84 Trillion (As of December 2011)

Settlement Cycle: T+3 business days (excluding margin accounts and negotiated settlements)

Most Active Stocks in USD

- CYAN

- LLOY

- YELL

- VOD

- BARC

Biggest Weight in the Index

- HSBC 6.77 %

- Vodafone 5.72%

- BP 5.64%

- Royal Dutch Shell 5.37%

Trading

Order Types

- Limit Order

- Market

- Order Validity - Good for Day (GFD), Good Till Date (GTD).

United States - NASDAQ

General Information

Index: NASDAQ Composite (tracking symbol: QQQ)

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies: USD (United States Dollar)

| Working Hours: | 09.30 am – 04.00 pm Local Time (US Eastern Standard Time) | |||||

|

No of Listed Companies: 2,784 Listed Companies

Market Capital: $13.55 Trillion (As of December 2011)

Settlement Cycle: T+3 business days (excluding margin accounts and negotiated settlements)

Most Active Stocks in USD

- SIRI

- MSFT

- INTC

- QQQ

- MU

Biggest Weight in the Index

- Apple 12.47 %

- Microsoft 5.63%

- Oracle 3.39%

- Google 3.32%

Trading

Order Types

- Limit Order

- Market

- Stop

- Stop Limit

- Order Validity - Good for Day (GFD), Good Till Date (GTD)

United States - NYSE

General Information

Index: Dow Jones Industrial Average

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies: USD (United States Dollar)

| Working Hours: | 09.30 am – 04.00 pm Local Time (US Eastern Standard Time) | |||||

|

No of Listed Companies: Over 8,000 Listed Companies

Market Capital: $14.242 Trillion (As of December 2011)

Settlement Cycle: T+3 business days (excluding margin accounts and negotiated settlements)

Most Active Stocks in USD

- CHK

- BAC

- NOK

- F

- S

Biggest Weight in the Index

- IBM 11.04 %

- Chevron 6.32%

- McDonalds 5.41%

- 3M 5.33%

Trading

Order Types

- Limit Order

- Market

- Stop Orders

- Stop Limit

- Order Validity - Good for Day (GFD), Good Till Date (GTD)

The Options Price Reporting Authority (OPRA)

General Information

OPRA is the securities information processor for market information generated by trading of securities options in the United States. OPRA (Options Price Reporting Authority) is a national market system plan that governs the process by which options market data are collected from participant exchanges, consolidated, and disseminated. Consolidated data help ensure that broker-dealers, markets, and investors have the best prices available for an option, from all markets trading that option class. It assists customers in setting the terms of their orders and in monitoring how well their brokers execute their orders. Consolidated data also assist brokers and markets in providing the best execution possible for an order. Also involved in the Options pricing and information distribution is The Options Clearing Corporation (OCC). OCC, founded in 1973, is the world's largest equity derivatives clearing organization. We are dedicated to promoting stability and financial integrity in the marketplaces that we serve by focusing on sound risk management principles. By acting as guarantor, we ensure that the obligations of the contracts we clear are fulfilled.

Working Days:Mon Tue Wed Thu Fri Sat Sun

Currencies: USD (United States Dollar)

| Working Hours: | 09.30 am – 04.00 pm Local Time (US Eastern Standard Time) | |||||

|

Volume: http://www.theocc.com/webapps/exchange-volume

Settlement Cycle: T+3 business days (excluding margin accounts and negotiated settlements)

Most Active Stocks in USD

- SIRI

- MSFT

- INTC

- QQQ

- MU

Biggest Weight in the Index

- Apple 12.47 %

- Microsoft 5.63%

- Oracle 3.39%

- Google 3.32%

Trading

Order Types

- Limit Order

- Market

- Stop

- Stop Limit

- Order Validity - Good for Day (GFD), Good Till Date (GTD)

How to compute Options trade cost

1 equity contract equals or controls 100 underlying shares.

- (***for index equity options the control factor is 50 shares).

Number of Contracts multiplied by BID or ASK price for the contract multiplied by number of shares controlled = trade value.

To calculate options trade commission:

$10 flat fee + $1.25 per contract.

Or

$10 flat fee + $1 per contract.